Depreciation Rate Formula

Depreciation per year Book value Depreciation rate. Firstly determine the value of the fixed asset which is its purchase price.

Declining Balance Depreciation Calculator

4 Ways To Calculate Depreciation On Fixed Assets Wikihow

Depreciation Rate Formula Examples How To Calculate

Ri indicates the depreciation rate for year i depends on the assets cost recovery period.

Depreciation rate formula. The depreciation formula is. Depreciation is the accounting process of converting the original costs of fixed assets such as plant and machinery equipment etc into the expense. D j d j C.

Under the MACRS the depreciation for a specific year j D j can be calculated using the following formula where C is the depreciation basis cost and d j is the depreciation rate. It refers to the decline in the value of fixed assets due to their usage passage of time or obsolescence. Di C Ri.

Useful life 5. Using the MACRS Tables. The CAGR formula is a way of calculating the Annual Percentage Yield APY 1rn-1 where r is the rate per period and n is the number of compound periods per year.

The depreciation formula is pretty basic but finding the correct depreciation rate d j is the difficult part because it depends on a number of factors governed by the IRS. So the manufacturing company will depreciate the machinery with the amount of 10000 annually for 5 years. Each year the depreciation expense is then calculated by multiplying the number of miles driven by the per-mile depreciation rate.

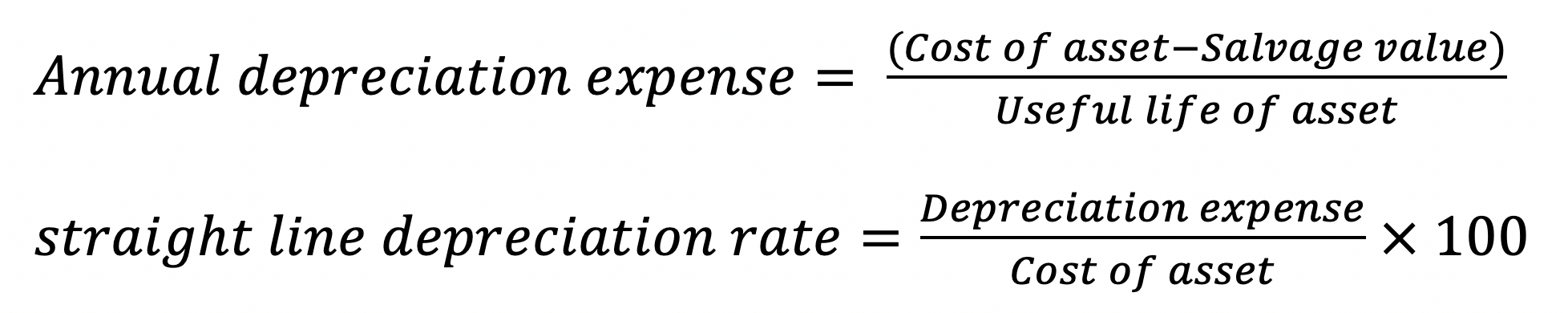

The formula of Depreciation Expense is used to find how much value of the asset can be deducted as an expense through the income statement. Amount of Depreciation Cost of Asset Net Residual Value Useful Life. Depreciation rates used in the declining balance method could be 150 200 double or 250 of the straight-line rate.

The company takes 50000 as the depreciation expense every year for the next 5 years. Relevance and Uses of Depreciation Expenses Formula. Straight line depreciation percent 15 02 or 20 per year.

Di indicates the depreciation in year i C indicates the original purchase price or basis of an asset. Calculate the rate of depreciation is 15. Applying the formula 50000 5 10000.

Depreciation Value Straight Line is not higher so we do not switch. On the income statement it represents non-cash expense but it reduces net income too. Read about the depreciation formula and Expense.

Next determine the assets residual value which is the expected value of the asset at the end of its usefulness. The formula is given below. Furthermore depreciation is a non cash expense as it does not involve any outflow of cash.

When the depreciation rate for the declining balance method is set as a. In case of straight-line depreciation calculation the amount of expense is the same for each year of the asset lifespan. Use this calculator to calculate an accelerated depreciation of an asset for a specified period.

The types of depreciation calculation owing to its methods are indicated below. Lower net income results in lower tax liability too. Company X considers depreciation expenses for the nearest whole month.

A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the Double Declining Balance MethodUse this calculator for example for depreciation rates entered as 15 for 150 175 for 175 2 for 200 3 for 300 etc. Calculate the depreciation expenses for 2012 2013 2014 using a declining balance method. Depreciation for the year 2012 Rs.

We still have 167772 - 1000 see first picture bottom half to depreciate. Stay tuned to BYJUS. To implement the double-declining depreciation formula for an Asset you need to know the assets purchase price and its useful life.

Depreciation Expense is very useful in finding the use of assets each accounting period to stakeholders. Example of straight-line depreciation without the salvage value. The cost saving is equivalent to revenue and would therefore be treated as net cash inflow.

Sum-of-years-digits method edit Sum-of-years-digits is a shent depreciation method that results in a more accelerated write-off than the straight-line method and typically also more accelerated than the declining balance method. However for the Income Tax purposes if an asset is used for more than 180 days full years depreciation will be charged. Depreciation Tax Shield Example.

D P - A. The average car. For example if a company has an annual depreciation Depreciation Schedule A depreciation schedule is required in financial modeling to link the three financial statements income balance sheet cash flow in Excel.

The formula for depreciation under the straight-line method can be derived by using the following steps. A weak currency or lower exchange rate depreciation can be better for an economy and for firms that export goods to other countries. A P 1 - R100 n.

If we use Straight line method this results in 2 remaining depreciation values of 67772 2 33886. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. On the top 10 list for cars with the highest rates of depreciation BMW accounted for three spots on the list.

Depreciation may be defined as the decrease in the value of the asset due to wear and tear over a period of time. For an investment the period may be shorter or longer than a year so n is calculated as 1Years or 365Days depending on whether you want to specify the period in Years or Days. Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion.

The most widely used method of depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. In period 9 Depreciation Value DDB 33554. Use a depreciation factor of two when doing calculations for double declining balance depreciation.

The Car Depreciation Calculator uses the following formulae. In our example the required investment is 8475 and the net annual cost saving is 1500. Among the top 10 vehicles with the lowest depreciation Toyota and Jeep accounted for five of the spots on the list.

Depreciation rate 20 2 40 per year. It uses the rate of depreciation on the closing asset value of the asset. 1 Scrap ValueAsset Value 1Life Span In the end the template displays the depreciation schedule for the diminishing balance method.

Its value indicates how much of an assets worth has been utilized. Of 2000 and the rate of tax is set at 10 the tax savings for the period is 200. Formula of internal rate of return factor.

The template calculates the Rate of Depreciation applying the following formula. The CAGR Formula Explained. 100000 40 912.

Depreciation is the gradual decrease in the book value of the fixed assets. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. The rate of Depreciation Annual Depreciation x 100 Cost of Asset.

Tax benefits also take place in depreciation. Using this information the internal rate of return factor can be computed as follows. First Divide 100 by the number of years in the assets useful life this is your straight-line depreciation rate.

What Is Accumulated Depreciation How To Calculate Examples More

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculation

Aasaan Io Blog

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Fixed Assets Double Entry Bookkeeping

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

Annual Depreciation Of A New Car Find The Future Value Youtube